Car Insurance in Texas

Finding the car insurance in Texas that matches your needs is essential for legal protection and peace of mind. The Lone Star State is home to millions of drivers, and with diverse driving conditions, having the right coverage matters. This guide explores and compares major providers like GEICO, Progressive, State Farm, Allstate, Liberty Mutual, The General,Travelers, and Texas Farm Bureau, helping you make an informed choice.

Compare quotes from top providers

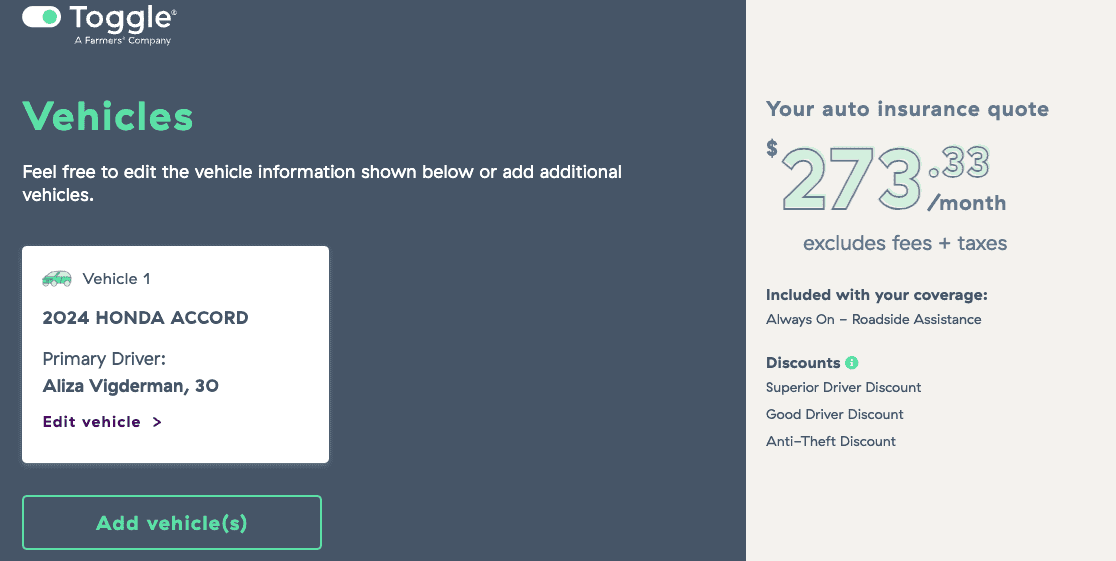

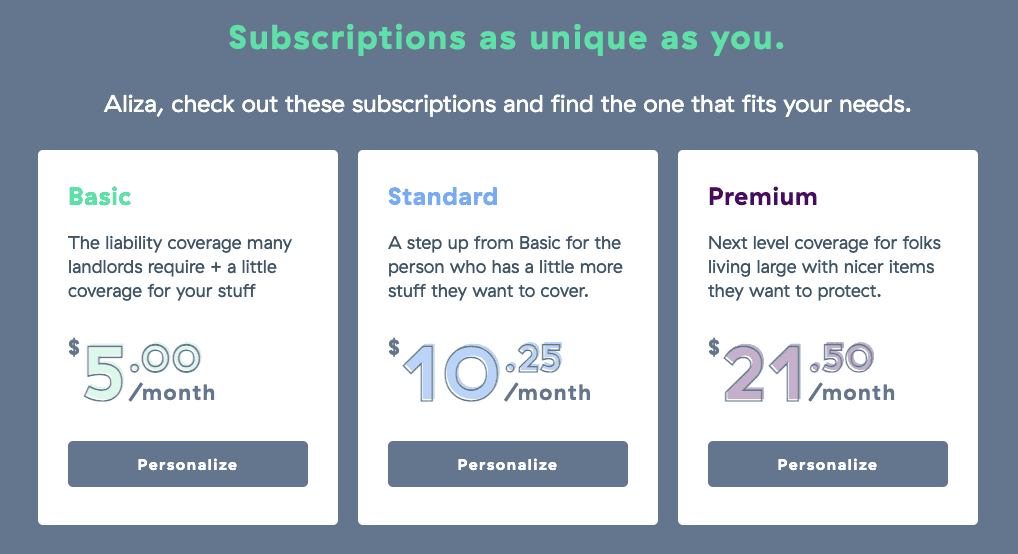

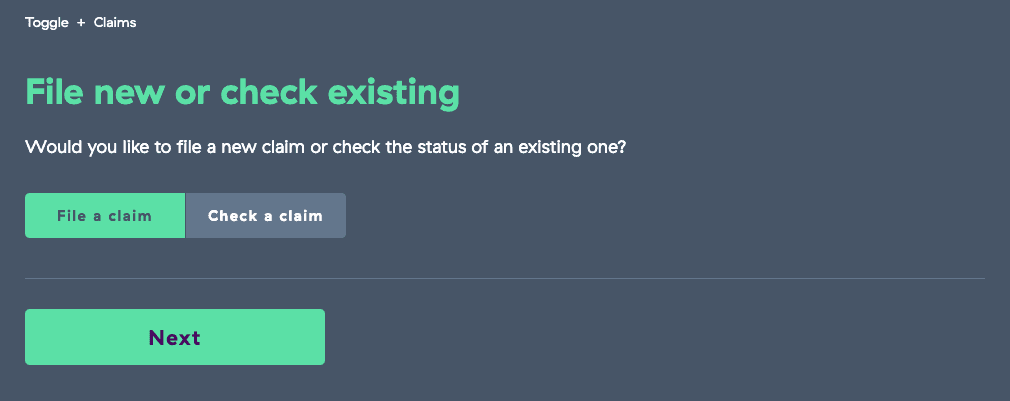

I’ve been reviewing auto insurance companies for a long time, so when I came across a company I hadn’t heard of before called Toggle, I was intrigued. It turns out Toggle is Farmer’s latest brand, and many 21st Century customers are being migrated to it. For everyone else, Toggle is available in just 14 states: Arizona, California, Colorado, Georgia, Illinois, Indiana, Missouri, Ohio, Oregon, South Carolina, Tennessee, Texas, Virginia, and Wisconsin. The company has no local agents. Rather, the entire process, from buying to managing your policy, takes place on its website or via its call center. Is it the right insurance company for you? Let’s decide together.

When it comes to insurance, there’s no one-size-fits-all. If you’re not sure where to start, check out our top picks for the best auto insurance companies.

Texas Car Insurance Requirements

Meeting texas car insurance requirements is mandatory for all drivers. As per texas state minimum car insurance coverage, your policy must include:

- $30,000 bodily injury per person

- $60,000 bodily injury per accident

- $25,000 property damage

Providers like state farm texas, geico texas, and liberty mutual offer policies that fulfill or exceed these minimum requirements. Getting full coverage is often a wise upgrade for better protection.

State of Texas Car Insurance – Overview of Major Brands

The state of texas car insurance market is served by both national leaders and local names. Key options include:

- Geico Texas – Fast claims, tech-driven tools, and strong car insurance rates

- Progressive – Snapshot program and high customization

- State Farm Texas – Excellent agent support and bundling options

- Allstate – Known for Drivewise and multiple discount tiers

- Liberty Mutual – RightTrack program and flexible coverages

- The General – Ideal for high-risk and SR-22 cases

- Travelers – Smart tech solutions and green vehicle benefits

- Texas Farm Bureau – Texas-based with a local touch and competitive pricing

H3: Texas Car Insurance Rates – Brand Comparison Table

|

Brand |

Coverage Levels |

Avg Price Range |

Discounts |

Satisfaction |

Notable Features |

|

Geico Texas |

Liability to full coverage |

$90–$140/mo |

Multi-policy, military |

High |

Mobile-first experience |

|

Progressive |

Custom policies |

$100–$160/mo |

Snapshot, student |

Moderate to High |

Telematics, app tools |

|

State Farm TX |

Comprehensive coverage |

$95–$150/mo |

Student, safe driver |

Excellent |

Strong local agents |

|

Allstate |

Wide range of options |

$105–$170/mo |

Milewise, Drivewise |

High |

Telematics savings |

|

Liberty Mutual |

Broad selection |

$100–$160/mo |

RightTrack, multi-policy |

Moderate |

Custom quotes and roadside help |

|

The General |

SR-22, high-risk |

$120–$180/mo |

Basic options |

Mixed |

Quick approval |

|

Travelers |

Hybrid/EV packages |

$95–$145/mo |

Safe driver, multi-policy |

High |

EV coverage, online tools |

Car Insurance Quote in Texas – Coverage Options

When you request a car insurance quote in texas, you’ll be offered options such as:

- Liability coverage (required minimum)

- Personal Injury Protection (PIP)

- Uninsured/Underinsured Motorist Coverage

- Comprehensive and Collision

- Optional full coverage packages

Providers like lemonade car insurance texas and liberty mutual are known for flexible plans. Use an auto quote online tool to explore the best setup for your vehicle and budget.

Cheap Texas Car Insurance – Discounts & Savings

Getting cheap texas car insurance is possible with discounts like:

- Drivewise (Allstate) and RightTrack (Liberty Mutual) for safe drivers

- Bundling home and auto

- Good student, military, and senior savings

- Usage-based options like Snapshot from Progressive

Usaa car insurance offers excellent rates to military families. Use the usaa insurance quote or state farm auto insurance quote tools to explore your eligibility.

Cheapest Full Coverage Car Insurance in Texas

Drivers seeking the cheapest full coverage car insurance in texas should compare:

- Liability, collision, and comprehensive coverage

- Optional add-ons like rental car reimbursement

Top choices include geico texas, progressive, and usaa car insurance, with flexible deductibles and great claim reputations. Full coverage is essential for new or financed vehicles.

Most Affordable Car Insurance in Texas – Experience & Service

The most affordable car insurance in texas balances price with convenience. Look for:

- Online tools like state farm quote auto

- Local support near me via state farm texas or Texas Farm Bureau

- 24/7 help through usaa auto insurance phone number and usaa customer service 24/7

Brands like liberty mutual and usaa offer reliable digital platforms and claims systems.

Texas Liability Car Insurance – Know the Risks

Choosing texas liability car insurance covers only third-party damages. While it meets texas car insurance laws, it leaves your own vehicle unprotected.

Experts at state farm car insurance rates and geico texas often recommend extended policies for risks like storms, flooding, and high-speed collisions.

Best Full Coverage Car Insurance in Texas – When to Upgrade

Upgrade to the best full coverage car insurance in texas if you want:

- Vehicle protection in any scenario

- Add-ons like roadside help and rental car access

- Higher coverage limits

Brands like Texas Farm Bureau and liberty mutual offer high-value plans perfect for new vehicles or high-mileage drivers.

Best Car Insurance for Texas – Choose Wisely

Selecting the best car insurance for texas depends on your needs:

- Want tech tools? Try progressive or lemonade car insurance texas

- Need military perks? Go with usaa car insurance

- Prefer personal agents? Choose state farm texas or Texas Farm Bureau

Check multiple providers and don’t rely on price alone—coverage quality and service matter too.

Texas State Minimum Car Insurance Coverage – Understand the Limits

The texas state minimum car insurance coverage of 30/60/25 may leave you underinsured. Providers like geico texas and state farm texas offer affordable upgrades.

Ask about PIP, uninsured motorist, and higher property limits if you drive often or live in high-risk areas.

Texas Car Insurance Laws – What to Know

Staying compliant with texas car insurance laws avoids penalties and protects your finances. Be aware:

- You must carry proof of insurance at all times

- Driving without insurance can lead to license suspension

- SR-22 is needed for high-risk or reinstated drivers

Use state farm texas or usaa insurance quote tools to explore legally compliant plans.

Texas Rental Car Insurance Law – Stay Protected

The texas rental car insurance law allows personal coverage to extend to rental vehicles in most cases.

Still, confirm that your policy (e.g., with liberty mutual or usaa car insurance) includes:

- Liability and collision for rentals

- Coverage limits that meet agency requirements

- Optional rental reimbursement benefits

Best Cheap Car Insurance in Texas – Final Advice

To find the best cheap car insurance in texas, be proactive:

- Use comparison tools like auto quote online

- Ask about discounts from state farm texas, usaa, and geico texas

- Bundle your policies and avoid coverage lapses

Reassess your plan yearly to make sure it still suits your driving habits.

Best Car Insurance Companies in Texas – FAQs

How much is car insurance in Texas?

Between $1,300–$1,800 annually depending on coverage and location.

What is the minimum car insurance required in Texas?

30/60/25 liability coverage is the legal minimum.

Do you need insurance to register a car in Texas?

Geico texas, usaa car insurance, and The General are strong candidates.

What do I need to get car insurance in Texas?

Driver’s license, vehicle details, and past insurance info

What is full coverage car insurance in Texas?

It includes liability, collision, comprehensive, and optional extras.

What is the best car insurance in Texas?

Usaa, state farm texas, and liberty mutual are top-rated.

Can you get car insurance without a license in Texas?

Some providers allow it, but options are limited.

How long do you have to get insurance after buying a used car in Texas?

Typically, 2–30 days with a new car insurance grace period.

Does your car insurance and registration have to be under the same name in Texas?

Yes, unless you qualify for a specific exception.

Who is eligible for USAA insurance?

Military members, veterans, and their direct family members.

Is Liberty Mutual good car insurance?

Yes, liberty mutual offers competitive rates, good service, and mobile tools.

Conclusion – Compare the Best Car Insurance Companies in Texas

Finding the right provider means comparing best car insurance companies in texas by price, service, and coverage. Whether you're looking for liability, full protection, or usage-based pricing—quotes help.

Ready to protect your vehicle in Texas? Get a free quote today from top brands like Geico Texas, USAA, and State Farm Texas to see how much you could save in 2025